Notice of 2020 9:00 a.m., Pacific Time Wednesday, May 27, 2020 Virtual Meeting Site:www.virtualshareholdermeeting.com/AMZN2020 |

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under§240.14a-12 | |

AMAZON.COM, INC.

(NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

(NAME OF PERSON(S) FILING PROXY STATEMENT, IF OTHER THAN THE REGISTRANT)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Notice of 2020 9:00 a.m., Pacific Time Wednesday, May 27, 2020 Virtual Meeting Site:www.virtualshareholdermeeting.com/AMZN2020 |

|

2019 Global Impact Highlights Our Planet | ||

Amazon announced The Climate Pledge with ourco-founder Global Optimism. The Climate Pledge is a commitment to be net zero carbon by 2040, a decade ahead of the Paris Agreement. Amazon is making significant investments in renewable energy and sustainability initiatives: • Running on 100% renewable energy by 2030. Amazon has over 86 renewable energy projects, including 26 utility-scale wind and solar farms and 60 solar rooftops installed on fulfillment centers and sort centers around the globe. |  | |

• Purchasing 100,000fully electric deliveryvehicles fromRivian, the largest order ever for electric delivery vehicles. These vans are expected to save 4 million metric tons of carbon per year by 2030. • Investing $100 million in nature-based climate solutions and reforestation projects, in partnership withThe Nature Conservancy, to begin removing carbon from the atmosphere now. • Eliminating packaging waste. Since 2008, our Frustration Free Packaging program has saved more than 810,000 tons of packaging material and eliminated the use of 1.4 billion shipping boxes. • Investing $10 million in the Closed Loop Fund to help ensure material gets back into the manufacturing supply chain. Over the next decade, Amazon’s investment is expected to increase the availability of curbside recycling for 3 million homes in the U.S. Shopping online reduces your carbon emissions Amazon’s sustainability scientists have spent more than three years developing the models, tools, and metrics to measure our carbon footprint. Their detailed analysis has found that shopping online consistently generates less carbon than driving to a store, since a single delivery van trip can take approximately 100 roundtrip car journeys off the road on average. Our scientists developed a model to compare the carbon intensity of ordering Whole Foods Market groceries online versus driving to your nearest Whole Foods Market store. The study found that, averaged across all basket sizes, online grocery deliveries generate 43% lower carbon emissions per item compared to shopping in stores. Smaller basket sizes generate even greater carbon savings. Our sustainability website provides comprehensive reporting on our carbon footprint and progress on our commitments. Learn more atsustainability.aboutamazon.com. | ||

Our Communities

We are committed to helping more children and young adults, especially those from underrepresented and underserved communities, have the resources and skills they need to build their best future. Our programs include:

| • | Increasing access to Science, Technology, Engineering, and Math education. Amazon FutureEngineer is a four-partchildhood-to-career program in the U.S. and U.K. that inspires millions of kids to explore computer science. Last year in the U.S., we provided over 100,000 young people in over 2,000 high schools access to computer science courses; brought robotics programs to more than 150 schools; and awarded 100 students $40,000 scholarships and paid Amazon internships. |

Increasing access to food, shelter, and basic goods for children and their

families. We are donating more than $130 million over 10 years to Seattle-based

nonprofit partners such as Mary’s Place and FareStart. In 2020, we opened afirst-

of-its-kind Mary’s Place homeless shelter with space for 275 people each night in

one of our Seattle headquarters buildings.

Supporting worldwide relief operations following natural disastersby leveraging Amazon’s logistics network. For example, Amazon and its customers donated cash and more than 400,000 relief items to support those affected by Hurricane Dorian in the Bahamas and the U.S.

Enabling customer-directed giving programs—such as Charity Lists, Amazon Pay, Alexa skills, and AmazonSmile—for millions of customers to support causes they care about. AmazonSmile has helped hundreds of thousands of charitable organizations by facilitating more than $155 million in donations worldwide.

Responding toCOVID-19

Our teams worldwide are working around the clock to ensure we continue to provide essential services to individuals and communities during theCOVID-19 pandemic. Some of the ways Amazon is helping include:

Prioritizing delivering essential items like household staples, baby formula, and medical supplies so that people can safely get the products they need.

Donating to local nonprofits and community foundations, including cash donations in our headquarter regions—Puget Sound and Arlington—to support vulnerable populations. We donated 73,000 meals to 2,700 elderly and medically vulnerable individuals, and 8,200 laptops to Washington’s largest school district to ensure all students can participate in online learning. Amazon also committed £3.2 million to organizations in the U.K., including the British Red Cross and local institutions.

Providing free access to online computer science courses and online AP Computer Science test prep sessions to any student in need through Amazon Future Engineer.

Leveraging our fulfillment network to support nonprofits and relief organizations on the front lines of the outbreak. In the Seattle area, we are donating gift cards and helping to purchase items on Amazon.com. Globally, we’ve donated millions of items—such as medical isolation suits, protective masks, disposable gloves, and other medical supplies—to healthcare professionals.

Launching a $5 million Neighborhood Small Business Relief Fund to provide cash grants to Seattle-area small businesses that need assistance to get through economic challenges related toCOVID-19. Additionally, we are subsidizing rent for restaurant and retail tenants in the buildings Amazon owns.

Launching the AWS Diagnostic Initiativeto accelerateCOVID-19 research. As part of this, we are committing an initial investment of $20 million to accelerate diagnostic research, innovation, and development to speed our collective understanding and detection ofCOVID-19. The AWS Diagnostic Development Initiative began with participation from 35 global research institutions, startups, and businesses.

Learn more ataboutamazon.com/our-communities.

Our People

Over the last decade, no company has created more jobs than Amazon. We have created hundreds of thousands of jobs for people

with all types of experience, education, and skill levels. Amazon has over 590,000 employees in the U.S., 115,000 in Europe, and 95,000 in Asia. In 2019, we paid over $30 billion in compensation to employees in the U.S. alone. Amazon is where smart, passionate people come to obsess over customers.

• | We provide a$15/£9.50 minimum wage in the U.S. and U.K. for all full-time, part-time, temporary, and seasonal employees. |

• | Ourindustry-leading benefits include health insurance, 401(k), innovative parental leave, and Career Choice—a program that pre-pays 95% of tuition and fees for associates to earn certificates and associate degrees inhigh-demand occupations. |

• | Upskilling 2025 is a $700 million investment in programs to train over 100,000 employees by 2025 to help them move into more highly skilled roles. |

• | In the U.S.,Amazon is hiring and training more than 21,000 veterans and military spouses and has initiatives such as Amazon Apprenticeship, an upskilling program that has trained hundreds of military spouses and veterans. In the U.K., Amazon provides paid leave for Reservists for their mandatory training and is a signatory to the Armed Forces Covenant national pledge. |

Supporting employees during COVID-19

• | In March,we opened 100,000 new positions across our fulfillment and delivery network. In April, after successfully filling those roles, we announced we were creating another 75,000 jobs to respond to customer demand. |

• | We are investing more than $500 million,justthrough the end of April, to increase pay for our associates by $2 in |

the U.S., $2 in Canada, £2 in the U.K., and approximately

€2 per hour in many European countries to recognize the

important role our teams are playing. We are paying

associates double our regular rate for any overtime

worked—a minimum of $34 an hour—an increase from

time and a half.

We established the Amazon Relief Fund—with an initial $25 million in funding—to support our independent delivery service partners and their drivers, Amazon Flex participants, and temporary employees under financial distress.

| • | We are working hard to protect our employees,implementing 150 process changes in our operations network and physical stores, providing associates with masks, performing daily temperature checks, continuously deep cleaning and sanitizing facilities, and requiring social distancing. For more detail on our safety measures, visitwww.amazon.com/covid19safety. |

Learn more ataboutamazon.com/working-at-amazon andaboutamazon.com/job-creation-and-investment.

Our Partners

Sales by independent third-party sellers—mostly small andmedium-sized business (SMBs)—make up more than half the units sold in our stores. In 2019, we invested $15 billion in infrastructure, services and tools, programs, and people to enable the success of these businesses.

SMBs selling their products on Amazon have created more than 830,000 jobs in the U.S. and 1.6 million worldwide. SMBs not only sell their products in our stores, they also:

| • | Run delivery companies. Amazon’s innovative new Delivery Service Partner program is helping entrepreneurs build their own delivery companies. |

Use AWS to run their businesses. AWS offers low cost,on-demand IT

solutions to help startups build and launch their applications and services.

Build Alexa skills. The Alexa Fund partners with outside developers to expand Alexa’s skills and grow their own brands.

Publish their own books. Kindle Direct Publishing enabled over a thousand independent authors to surpass $100,000 in royalties in 2019.

Amazon believes the people, workers, and communities who support our business should be treated with fundamental dignity and respect. We respect and support the Core Conventions of the International Labour Organization (ILO), the ILO Declaration on Fundamental Principles and Rights at Work, and the United Nations Universal Declaration of Human Rights. Significant announcements in 2019 include:

Global Human Rights Principles. These ways of operating have been long-held at Amazon, and codifying them demonstrates our support for fundamental human rights and the dignity of workers everywhere we operate.

Supply chain and supplier code of conduct. We require suppliers in our manufacturing supply chain and those supporting Amazon’s operations to comply with our publicly available Supply Chain Standards. In 2019, we disclosed a supplier map forAmazon-branded products, including apparel, consumer electronics, and home goods.

Learn more ataboutamazon.com/supporting-small-businesses andaboutamazon.com/our-company/our-positions.

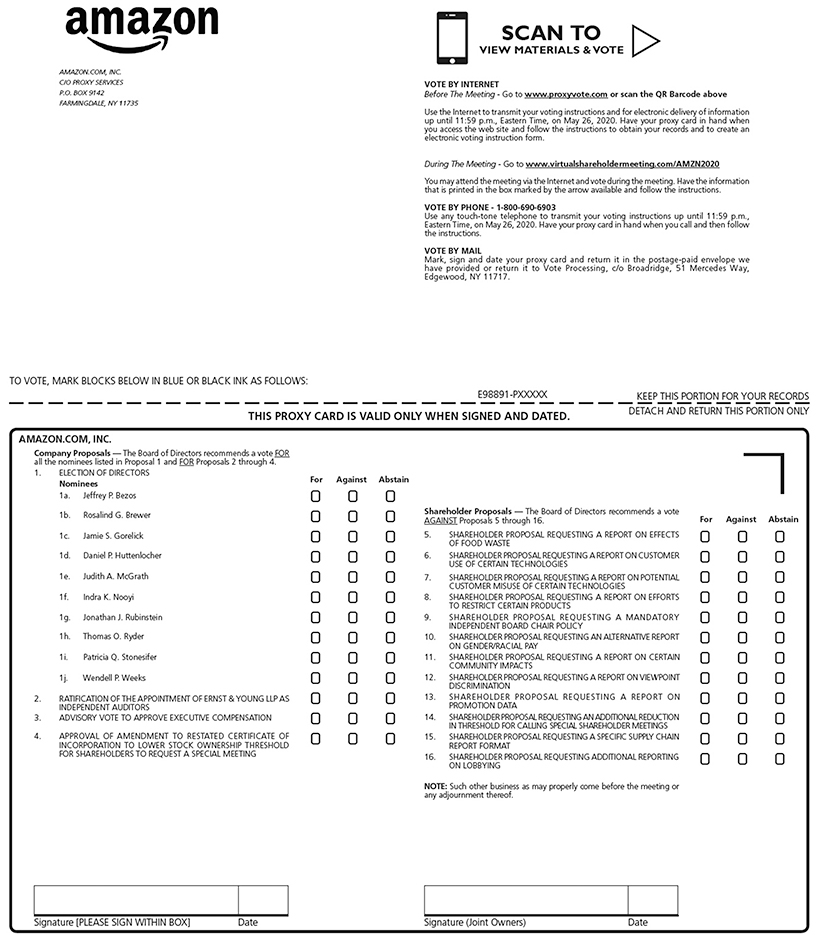

NOTICE OF 20192020 ANNUAL MEETING

OF SHAREHOLDERS

To Be Held on Wednesday, May 22, 2019

| Date and Time |  | Virtual Meeting Site |

Wednesday, May 27, 2020 9:00 a.m., Pacific Time | www.virtualshareholdermeeting.com/AMZN2020 | |||||||

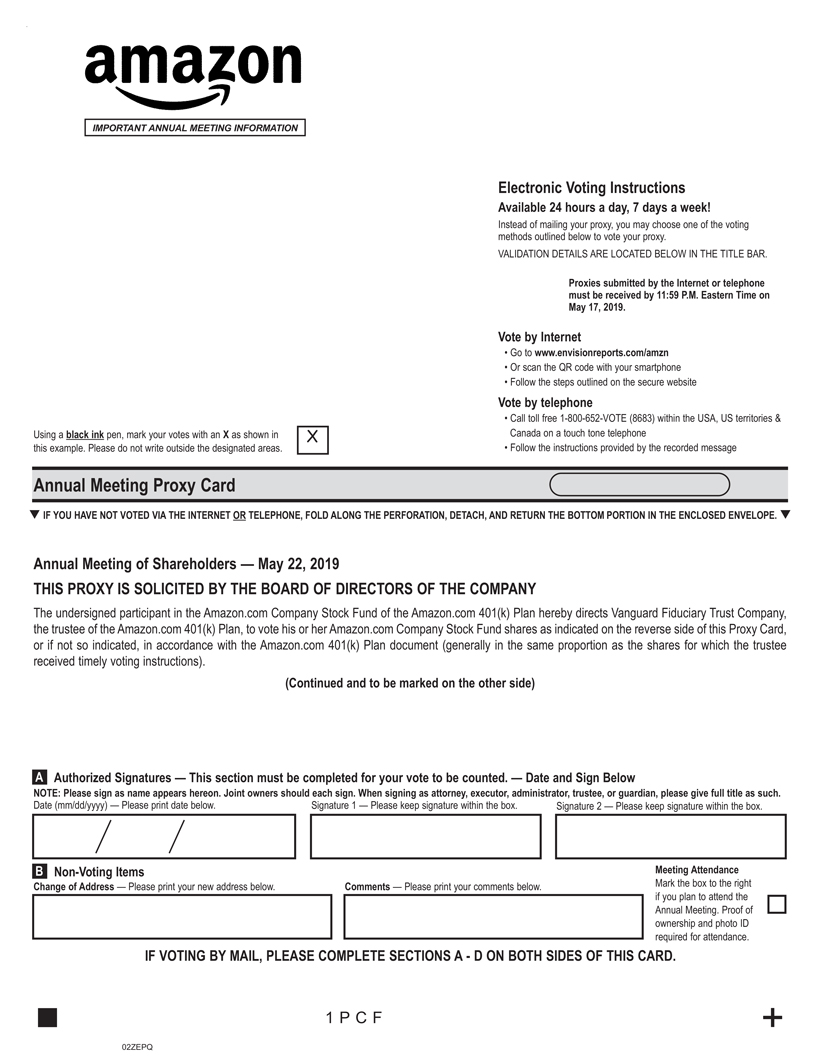

The 2019 Annual Meeting of Shareholders of Amazon.com, Inc. (the “Annual Meeting”) will be held at 9:00 a.m., Pacific Time, on Wednesday, May 22, 2019, at Fremont Studios, 155 N. 35th Street, Seattle, Washington 98103, for the following purposes:

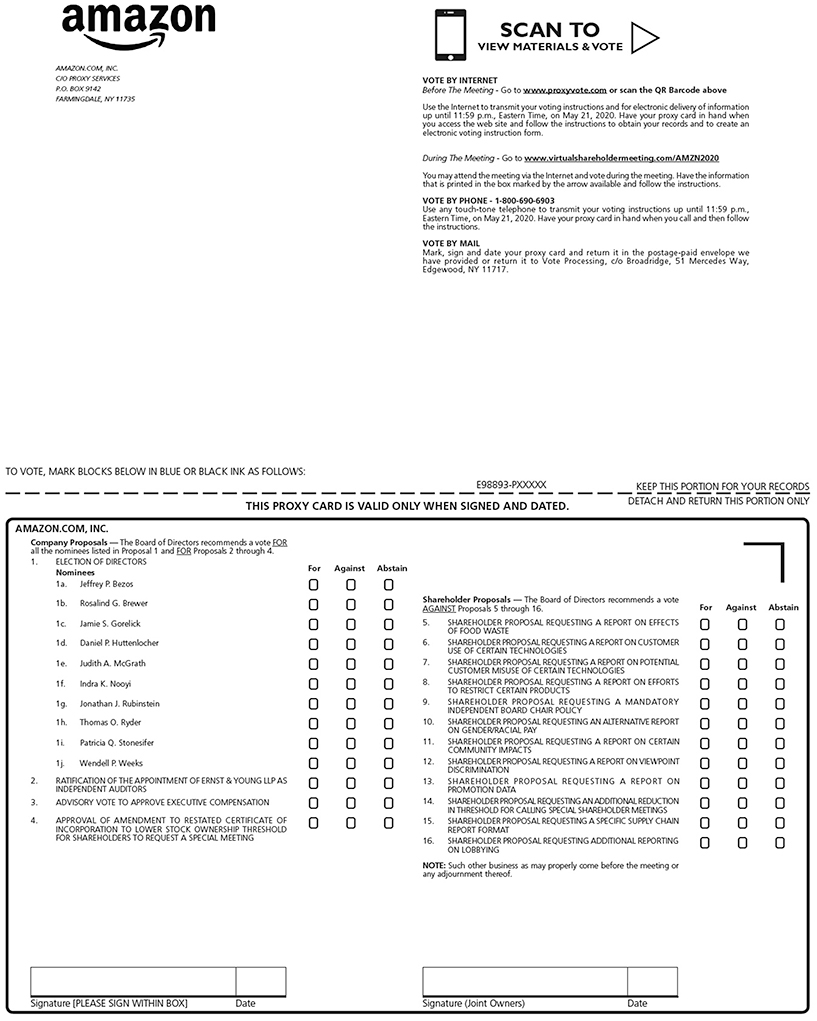

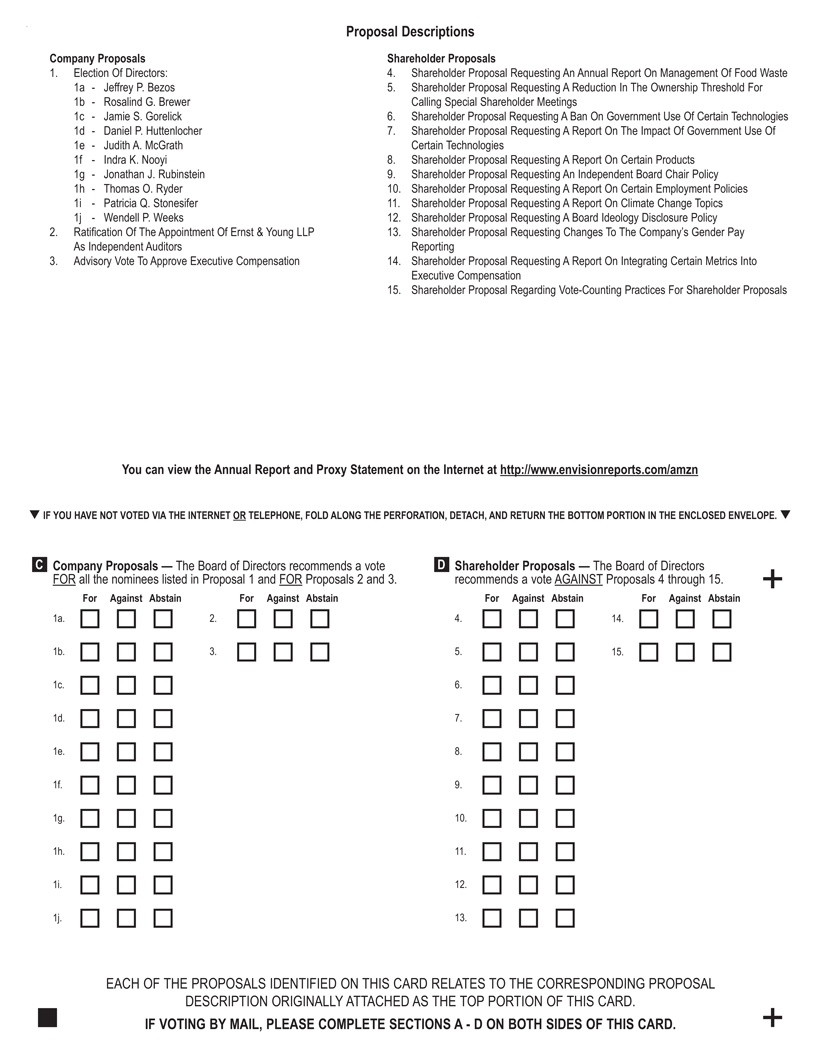

1. To elect the ten directors named in the Proxy Statement to serve until the next Annual Meeting of Shareholders or until their respective successors are elected and qualified;

2. To ratify the appointment of Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2019;

3. To conduct an advisory vote to approve our executive compensation;

4. To consider and act upon the shareholder proposals described in the Proxy Statement, if properly presented at the Annual Meeting; and

5. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

Our Board of Directors recommends you vote: (i) “FOR” the election of each of the nominees to the Board; (ii) “FOR” the ratification of the appointment of Ernst & Young LLP as independent auditors; (iii) “FOR” approval, on an advisory basis, of our executive compensation as described in the Proxy Statement; and (iv) “AGAINST” each of the shareholder proposals.

| Items of Business: | Our Board of Directors Recommends You Vote: | |

• To elect the ten directors named in the Proxy Statement to serve until the next Annual Meeting of Shareholders or until their respective successors are elected and qualified |

| |

• To ratify the appointment of Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2020 |

| |

• To conduct an advisory vote to approve our executive compensation |

| |

• To approve an amendment to our Restated Certificate of Incorporation to lower the stock ownership threshold from 30% to 25% for shareholders to request a special meeting |

| |

• To consider and act upon the shareholder proposals described in the Proxy Statement, if properly presented at the Annual Meeting |

| |

• To transact such other business as may properly come before the meeting or any adjournment or postponement thereof | ||

The Board of Directors has fixed March 28, 2019April 2, 2020 as the record date for determining shareholders entitled to receive notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. Only shareholders of record at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting.

By Order of the Board of Directors

David A. Zapolsky Secretary

|

Seattle, Washington

April 11, 201916, 2020

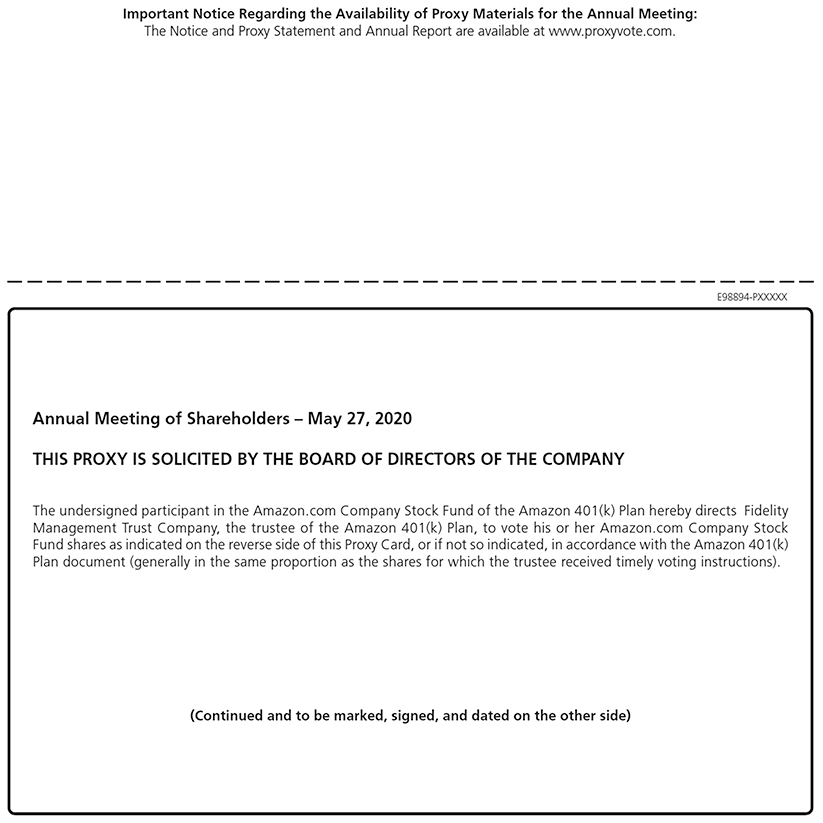

Important Notice Regarding the Availability of Proxy Materials for the Amazon.com, Inc. Shareholder

Meeting to be Held on May 22, 2019

27, 2020.The Proxy Statement and our 20182019 Annual Report are available atwww.envisionreports.com/amznwww.proxyvote.com.

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical or current facts, including statements regarding our environmental and other sustainability plans and goals, made in this document are forward-looking. We use words such as anticipates, believes, expects, future, intends, and similar expressions to identify forward-looking statements. Forward-looking statements reflect management’s current expectations and are inherently uncertain. Actual results could differ materially for a variety of reasons. Risks and uncertainties that could cause our actual results to differ significantly from management’s expectations are described in our 2019 Annual Report on Form10-K. Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document.

AMAZON.COM, INC.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To Be Held on Wednesday, May 22, 201927, 2020

GeneralANNUAL MEETING INFORMATION

The enclosed proxy is solicited by the Board of Directors of Amazon.com, Inc. (“Amazon” or the “Company”) for use at the Annual Meeting of Shareholders to be held at 9:00 a.m., Pacific Time, on Wednesday, May 22, 2019, at Fremont Studios, 155 N. 35th Street, Seattle, Washington 98103,27, 2020, and at any adjournment or postponement thereof. We will conduct a virtual online Annual Meeting this year, so our shareholders can participate from any geographic location with Internet connectivity. We believe this is an important step to enhancing accessibility to our Annual Meeting for all of our shareholders and reducing the carbon footprint of our activities, and is particularly important for our shareholders, employees, and community this year in light of evolving public health and safety considerations posed by the potential spread of the coronavirus, orCOVID-19. Shareholders may view a live webcast of the Annual Meeting atwww.virtualshareholdermeeting.com/AMZN2020 and may submit questions during the Annual Meeting. Our principal offices are located at 410 Terry Avenue North, Seattle, Washington 98109. This Proxy Statement is first being made available to our shareholders on or about April 11, 2019.16, 2020.

Outstanding Securities and Quorum

Only holders of record of our common stock, par value $0.01 per share, at the close of business on March 28, 2019,April 2, 2020, the record date, will be entitled to notice of, and to vote at, the Annual Meeting. On that date, we had 492,053,396498,525,023 shares of common stock outstanding and entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each other item to be voted on at the Annual Meeting. A majority of the outstanding shares of common stock entitled to vote, present in person or represented by proxy, constitutes a quorum for the transaction of business at the Annual Meeting. Abstentions and broker nonvotes will be included in determining the presence of a quorum atfor the Annual Meeting.

Internet Availability of Proxy Materials

We are furnishing proxy materials to some of our shareholders via the Internet by mailing a Notice of Internet Availability of Proxy Materials, instead of mailing ore-mailing copies of those materials. The Notice of Internet Availability of Proxy Materials directs shareholders to a website where they can access our proxy materials, including our proxy statement and our annual report, and view instructions on how to vote via the Internet, mobile device, or by telephone. If you received a Notice of Internet Availability of Proxy Materials and would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials. If you have previously elected to

2020 Proxy Statement | 1 | |||

ANNUAL MEETING INFORMATION

receive our proxy materials viae-mail, you will continue to receive access to those materials electronically unless you elect otherwise.We encourage you to register to receive all future shareholder communications electronically, instead of in print. This means that access to the annual report, proxy statement, and other correspondence will be delivered to you viae-mail.

Shares that are properly voted via the Internet, mobile device, or by telephone or for which proxy cards are properly executed and returned will be voted at the Annual Meeting in accordance with the directions given or, in the absence of directions, will be voted in accordance with the Board’s recommendations as follows: “FOR” the election of each of the nominees to the Board named herein; “FOR” the ratification of the appointment of our independent auditors; “FOR” approval, on an advisory basis, of our executive compensation as described in this Proxy Statement; “FOR” approval of the amendment to our Restated Certificate of Incorporation; and “AGAINST” each of the shareholder proposals. It is not expected that any additional matters will be brought before the Annual Meeting, but if other matters are properly presented, the persons named as proxies in the proxy card or their substitutes will vote in their discretion on such matters.

Voting via the Internet, mobile device, or by telephone helps save money by reducing postage and proxy tabulation costs. To vote by any of these methods, read this Proxy Statement, have your Notice of Internet

1

Availability of Proxy Materials, proxy card, or voting instruction form in hand, and follow the instructions below for your preferred method of voting. Each of these voting methods is available 24 hours per day, seven days per week.

We encourage you to cast your vote by one of the following methods:

|  |  | ||||

VOTE BY INTERNET

http://www.proxyvote.com | VOTE BY QR CODE

|

| ||||

| VOTE BY TELEPHONE | ||||||

Shares Held of Record:

| ||||||

|

| |||||

Shares Held in Street Name:

| Shares Held in Street Name:

| Shares Held in Street Name:

| ||||

The manner in which your shares may be voted depends on how your shares are held. If you own shares of record, meaning that your shares are represented by certificates or book entries in your name so that you appear as a shareholder on the records of Computershare, our stock transfer agent, you may vote by proxy, meaning you authorize individuals named in the proxy card to vote your shares. You may provide this authorization by voting via the Internet, mobile device, by telephone, or (if you have received paper copies of our proxy materials) by returning a proxy card. You also may attendparticipate in and vote during the Annual Meeting and vote in person.Meeting. If you own common stock of record and you do not vote by proxy or in person at the Annual Meeting, your shares will not be voted.

If you own shares in street name, meaning that your shares are held by a bank, brokerage firm, or other nominee, you may instruct that institution on how to vote your shares. You may provide these instructions by voting via the Internet, mobile device, by telephone, or (if you have received paper copies of proxy materials through your bank, brokerage firm, or other nominee) by returning a voting instruction form received from that institution. If you own common stockYou also may participate in street name and attendvote during the Annual Meeting, you must obtain a “legal proxy” from the bank, brokerage firm, or other nominee that holds your shares in order to vote your shares at the meeting.Meeting. If you own common stock in street name and do not either provide voting instructions or vote atduring the Annual Meeting, the institution that holds your shares may nevertheless vote your shares on your behalf with respect to the ratification of the appointment of Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2019,2020, but cannot vote your shares on any other matters being considered at the meeting.

2 |

| |||||

ANNUAL MEETING INFORMATION

A nominee for director shall be elected to the Board if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election. If the votes cast for any nominee do not exceed the votes cast against the nominee, the Board will consider whether to accept or reject such director’s resignation, which is tendered to the Board pursuant to the Board of Directors Guidelines on Significant Corporate Governance Issues. Abstentions and broker nonvotes will have no effect on the outcome of the election. Broker nonvotes occur when a person holding shares in street name, such as through a brokerage firm, does not provide instructions as to how to vote those shares and the broker does not then vote those shares on the shareholder’s behalf.

For the amendment to our Restated Certificate of Incorporation, the affirmative vote of a majority of the outstanding shares of common stock entitled to vote is required to approve this matter. Abstentions and broker nonvotes, if any, are not counted as affirmative votes on this matter but are counted as outstanding and entitled to vote.

For all other matters proposed for a vote at the Annual Meeting, the affirmative vote of a majority of the outstanding shares of common stock present in person or represented by proxy and entitled to vote on the matter is required to approve the matter. For these matters, abstentions are not counted as affirmative votes on a matter but are counted as present at the Annual Meeting and entitled to vote, and broker nonvotes, if any, will have no effect on the outcome of these matters.

2

If you own common stock of record, you may revoke your proxy or change your voting instructions at any time before your shares are voted at the Annual Meeting by delivering to the Secretary of Amazon.com, Inc. a written notice of revocation or a duly executed proxy (via the Internet, mobile device, or telephone or by returning a proxy card) bearing a later date or by attendingparticipating in and voting during the Annual Meeting and voting in person.Meeting. A shareholder owning common stock in street name may revoke or change voting instructions by contacting the bank, brokerage firm, or other nominee holding the shares or by obtaining a legal proxy from such institutionparticipating in and voting in person atduring the Annual Meeting.

AttendingParticipating in the Annual Meeting

OnlyThis year’s Annual Meeting will be accessible through the Internet. We are conducting a virtual online Annual Meeting so our shareholders can participate from any geographic location with Internet connectivity. We believe this is an important step to enhancing accessibility to our Annual Meeting for all of our shareholders and reducing the carbon footprint of our activities, and is particularly important for our shareholders, employees, and community this year in light of evolving public health and safety considerations posed by the potential spread of the coronavirus, orCOVID-19. We have worked to offer the same participation opportunities as were provided at thein-person portion of our past meetings, while providing an online experience available to all shareholders regardless of their location. The accompanying proxy materials include instructions on how to participate in the meeting and how you may vote your shares.

You are entitled to participate in the Annual Meeting if you were a shareholder as of the close of business on April 2, 2020, the record date, or hold a valid proxy for the meeting. To participate in the Annual Meeting, including to vote and to view the list of registered shareholders as of the record date (March 28, 2019) are entitled to attendduring the Annual Meeting in person. Admission to the Annual Meeting will be on a first-come, first-served basis. Attendees should bring the appropriate materials described below in order to be admitted to the meeting.

Natural Persons. If you own common stock of record, your name will be on a list and you will be able to gain entry with a government-issued photo identification, such as a driver’s license, state-issued ID card, or passport. If you own common stock in street name, in order to gain entrymeeting, you must present a government-issued photo identificationaccess the meeting website atwww.virtualshareholdermeeting.com/AMZN2020 and proof of beneficial stock ownership as ofenter the record date that includes16-digit control number found on the same name that is on your government-issued photo identification. Acceptable forms of proof of beneficial stock ownership include your Notice of Internet Availability of Proxy Materials a copy of youror on the proxy card or voting instruction form ifprovided to you received one,with this Proxy Statement, or an account or brokerage statement showing stock ownership asthat is set forth within the body of the record date.email sent to you with the link to this Proxy Statement.

Entities.IfRegardless of whether you are a director, officer, trustee, or other legal representative of an entityplan to participate in the Annual Meeting, it is important that owns common stock of the Company, you must present a government-issued photo identification, evidence that you are authorized to act on behalf of the entityyour shares be represented and voted at the Annual Meeting,Meeting. Accordingly, we encourage you to log on towww.proxyvote.com and if the entity is a street name owner, proofvote in advance of the entity’s beneficial stock ownership as of the record date. Each entity that owns common stock of the Company may be represented by only one legal representative atAnnual Meeting.

Shareholders are able to submit questions for the Annual Meeting.

Meeting’s question and answer session during the meeting throughNon-Shareholders.www.virtualshareholdermeeting.com/AMZN2020. We will post answers to shareholder questions received regarding our Company on our investor relations website atwww.amazon.com/irIf you are not after the meeting. We also will post a shareholder and are not the representativereplay of an entity that owns common stock of the Company, you will be entitled to admission only if you are a proxy holder attending in lieu of a shareholder. To gain entry, you must present a government-issued photo identification and either a valid proxy from a shareholder of record authorizing you to vote the shareholder’s shares or, if you are a proxy holder for a street name shareholder, a valid legal proxy from the record holder or the bank, brokerage firm, or other nominee that holds shares on behalf of the street name shareholder. Only one proxy holder may attend on behalf of a shareholder.

You can find directions to, and supplemental information about, the Annual Meeting at www.amazon.com/ir. Cameras, recording devices,on our investor relations website, which will be available following the meeting. Additional information regarding the rules and other electronic devices are prohibitedprocedures for participating in the Annual Meeting will be set forth in our meeting rules of conduct, which shareholders can view during the meeting at the meeting.meeting website or during the ten days prior to the meeting atwww.proxyvote.com.

2020 Proxy Statement | 3 | |||

ANNUAL MEETING INFORMATION

We encourage you to access the Annual Meeting before it begins. Onlinecheck-in will be available atwww.virtualshareholdermeeting.com/AMZN2020 approximately 15 minutes before the meeting starts on May 27, 2020. If you have difficulty accessing the meeting, please call 800-586-1548 (toll free) or 303-562-9288 (international). We will have technicians available to assist you.

4 |

| |||||

In accordance with our Bylaws, the Board has fixed the number of directors constituting the Board at ten, effective as of the Annual Meeting.ten. The Board, based on the recommendation of the Nominating and Corporate Governance Committee, proposed that the following ten nominees be elected at the Annual Meeting, each of whom will hold office until the next Annual Meeting of Shareholders or until his or her successor shall have been elected and qualified:

|

|

3

Each of the nominees is currently a director of Amazon.com, Inc. and has been elected to hold office until the 20192020 Annual Meeting or until his or her successor has been elected and qualified. Ms. Brewer and Ms. Nooyi were elected as directors by the Board of Directors on February 4, 2019 and February 25, 2019, respectively, and the otherThe nominees were most recently elected at the 20182019 Annual Meeting. Biographical and related information on each nominee is set forth below. On April 5, 2019, Tom A. Alberg informed the Company that he would not stand for re-election at the Annual Meeting.

Although the Board expects that the ten nominees will be available to serve as directors, if any of them should be unwilling or unable to serve, the Board may decrease the size of the Board or may designate substitute nominees, and the proxies will be voted in favor of any such substitute nominees.

THE

The Board of Directors recommends a vote“FOR” each nominee. |

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH NOMINEE.INFORMATION

Director Nominees’ Biographical and Related Information

In evaluating the nominees for the Board of Directors, the Board and the Nominating and Corporate Governance Committee took into account the qualities they seek for directors, as discussed below under “Corporate Governance” and “Board Meetings and Committees,” and the directors’ individual qualifications, skills, and background that enable the directors to effectively and productively contribute to the Board’s oversight of Amazon. These individual qualifications and skills are includedAmazon, as discussed below in each nominee’s biography.

Biographical Information

Jeffrey P. Bezos, age 55, has been Chairmanbiography and under “Director Nominee Tenure, Skills, and Characteristics.” When evaluatingre-nomination of existing directors, the Committee also considers the nominees’ past and ongoing effectiveness on the Board since foundingand, with the Company in 1994 and Chief Executive Officer since May 1996.exception of Mr. Bezos, served as President from founding until June 1999 and again from October 2000 to the present. Mr. Bezos’ individual qualifications and skills as a director include his customer-focused point of view, his willingness to encourage invention, his long-term perspective, and hison-goingwho is an employee, their independence. contributions as founder and CEO.

Rosalind G. Brewer, age 56, has been a director since February 2019. Ms. Brewer has been the Group President, Americas and Chief Operating Officer of Starbucks Corporation, a roaster, marketer, and retailer of specialty coffee, since October 2017, where she has also served as a director since March 2017. From February 2012 to February 2017, she was President and Chief Executive Officer of Sam’s Club, a membership-only retail warehouse club and a division of Walmart Inc., and from 2006 to January 2012, she served in numerous leadership positions at various regional business units for Walmart. She served as a director of Lockheed Martin Corporation from April 2011 to October 2017. Ms. Brewer’s individual qualifications and skills as a director include her leadership and operations experience as a senior executive at large, multinational corporations, through which she gained experience with regulatory and compliance requirements applicable to public companies, as well as her customer experience skills.

Jamie S. Gorelick, age 68, has been a director since February 2012. Ms. Gorelick has been a partner with the law firm Wilmer Cutler Pickering Hale and Dorr LLP since July 2003. She has held numerous positions in the U.S. government, serving as Deputy Attorney General of the United States, General Counsel of the Department of Defense, Assistant to the Secretary of Energy, and a member of the bipartisan National Commission on Terrorist Threats Upon the United States. Ms. Gorelick has served as a director of VeriSign, Inc. since January 2015, a director of United Technologies Corporation from February 2000 to December 2014, and a director of Schlumberger Limited from April 2002 to June 2010. Ms. Gorelick’s individual qualifications and skills as a director include her experience as a lawyer, her leadership experience in senior governmental positions, including experience with regulatory and compliance matters, as well as her customer experience skills and skills relating to public policy and financial statement and accounting matters.

4

2020 Proxy Statement | 5 | |||

Daniel P. Huttenlocher, age 60, has been a director since September 2016. Mr. Huttenlocher has been Dean and Vice Provost, Cornell Tech at Cornell University since 2012, and has worked for Cornell University since 1988 in various positions. Mr. Huttenlocher has served as a director of Corning Incorporated since February 2015. Mr. Huttenlocher’s individual qualifications and skills as a director include his experience in senior positions at Cornell University, a leading university, Cornell Tech, a research, technology commercialization, and graduate-level educational facility, and the Xerox Palo Alto Research Center, a technology research facility, through which he gained experience with emerging technologies, as well as his customer experience skills.

Judith A. McGrath, age 66, has been a director since July 2014. Ms. McGrath serves as a senior advisor to Astronauts Wanted * No experience necessary, a multimedia joint venture that Ms. McGrath formed with Sony Music Entertainment, and served as President of Astronauts Wanted from June 2013 to March of 2018. The company is currently a subsidiary of Sony Pictures Television. Ms. McGrath served as Chair and Chief Executive Officer of MTV Networks Entertainment Group worldwide, a division of Viacom, Inc., including Comedy Central and Nickelodeon, from July 2004 until May 2011. She was part of the original founder and launch team for MTV. Ms. McGrath’s individual qualifications and skills as a director include her leadership and multimedia operations experience as a longtime senior executive of MTV Networks Entertainment Group, through which she gained experience with content creation, advertising, and content distribution, as well as her customer experience skills. Ms. McGrath further honed her digital and entrepreneurial experience with global customers in her role at Astronauts Wanted * No experience necessary.

Indra K. Nooyi, age 63, has been a director since February 2019. Ms. Nooyi was the Chief Executive Officer of PepsiCo, Inc., a multinational food, snack, and beverage company, from October 2006 to October 2018, where she also served as the Chairman of its board of directors from May 2007 to February 2019. She was elected to PepsiCo’s board of directors and became its President and Chief Financial Officer in 2001, and held leadership roles in finance, corporate strategy and development, and strategic planning after joining PepsiCo in 1994. Ms. Nooyi has served as a director of Schlumberger Limited since April 2015. Ms. Nooyi’s individual qualifications and skills as a director include her leadership experience as a longtime senior executive at a large corporation with international operations, through which she gained experience with consumer-focused product development, international operations, and marketing issues, as well as her customer experience skills and skills relating to financial statement and accounting matters.

Jonathan J. Rubinstein, age 62, has been a director since December 2010. Mr. Rubinstein wasco-CEO of Bridgewater Associates, LP, a global investment management firm, from May 2016 to April 2017. Previously, Mr. Rubinstein was Senior Vice President, Product Innovation, for the Personal Systems Group at the Hewlett-Packard Company (“HP”), a multinational information technology company, from July 2011 to January 2012, and served as Senior Vice President and General Manager, Palm Global Business Unit, at HP from July 2010 to July 2011. Mr. Rubinstein was Chief Executive Officer and President of Palm, Inc., a smartphone manufacturer, from June 2009 until its acquisition by HP in July 2010, and Chairman of the Board of Palm, Inc. from October 2007 through the acquisition. Prior to joining Palm, Mr. Rubinstein was a Senior Vice President at Apple Inc., also serving as the General Manager of the iPod Division. Mr. Rubinstein served as a director of Qualcomm Incorporated from May 2013 to May 2016. Mr. Rubinstein’s individual qualifications and skills as a director include his leadership and technology experience as a senior executive at large financial and technology companies, through which he gained experience with hardware devices and emerging technologies, as well as his customer experience skills and skills relating to financial statement and accounting matters.

Thomas O. Ryder, age 74, has been a director since November 2002. Mr. Ryder was Chairman of the Reader’s Digest Association, Inc. from April 1998 to December 2006, and was Chief Executive Officer from April 1998 to December 2005. From 1984 to 1998, Mr. Ryder worked in several roles at American Express, including as President of American Express Travel Related Services International. Mr. Ryder served as a director of ILG, Inc. from May 2016 to September 2018, a director of RPX Corporation from December 2009 to June 2017, a director of Quad/Graphics, Inc. from July 2010 to May 2017, a director of Starwood Hotels & ResortsBOARD OF DIRECTORS INFORMATION

Jeffrey P. Bezos Founder, Chairman, and CEO of Amazon | Background Mr. Bezos has been Chairman of the Board since founding the Company in 1994 and Chief Executive Officer since May 1996. Mr. Bezos served as President from founding until June 1999 and again from October 2000 to the present. Qualifications and Skills Mr. Bezos’ individual qualifications and skills as a director include his customer-focused point of view, his willingness to encourage invention, his long-term perspective, and hison-going contributions as founder and CEO. |

Age: | Director since: | Board committees: | Other current public company boards: | |||

56 | July 1994 | None | None | |||

Rosalind G. Brewer Group President, Americas and COO of Starbucks Corporation | Background Ms. Brewer has been the Group President, Americas and Chief Operating Officer of Starbucks Corporation, a roaster, marketer, and retailer of specialty coffee, since October 2017, where she has also served as a director since March 2017. From February 2012 to February 2017, she was President and Chief Executive Officer of Sam’s Club, a membership-only retail warehouse club and a division of Walmart Inc., and from 2006 to January 2012, she served in numerous leadership positions at various regional business units for Walmart. She served as a director of Lockheed Martin Corporation from April 2011 to October 2017. Qualifications and Skills Ms. Brewer’s individual qualifications and skills as a director include her leadership and operations experience as a senior executive at large, multinational corporations, through which she gained experience with regulatory and compliance requirements applicable to public companies, as well as her customer experience skills. |

Age: | Director since: | Board committees: | Other current public company boards: | |||

57 | February 2019 | Leadership Development and Compensation | Starbucks Corporation | |||

6 |

| |||||

Worldwide, Inc. from April 2001 to September 2016, and Chairman of the Board of Directors at Virgin Mobile USA, Inc. from October 2007 to November 2009. Mr. Ryder’s individual qualifications and skills as a director include his leadership experience as a senior executive of Reader’s Digest, a large media and publishing company, and American Express, a large financial services company, through which he gained experience with intellectual property, media, enterprise sales, payments, and international operations, as well as his customer experience skills and skills relating to financial statement and accounting matters.

Patricia Q. Stonesifer, age 62, has been a director since February 1997. Ms. Stonesifer served as the President and CEO of Martha’s Table, anon-profit, from April 2013 to March 2019. She served as Chair of the Board of Regents of the Smithsonian Institution from January 2009 to January 2012 and as Vice Chair from January 2012 to January 2013. From September 2008 to January 2012, she served as senior advisor to the Bill and Melinda Gates Foundation, a private philanthropic organization, where she was Chief Executive Officer from January 2006 to September 2008 and President andCo-chair from June 1997 to January 2006. Since September 2009, she has also served as a private philanthropy advisor. From 1988 to 1997, she worked in many roles at Microsoft Corporation, including as a Senior Vice President of the Interactive Media Division, and also served as the Chairwoman of the Gates Learning Foundation from 1997 to 1999. Ms. Stonesifer’s individual qualifications and skills as a director include her leadership experience as a senior executive at the Bill and Melinda Gates Foundation and at Microsoft, through which she gained experience with emerging technologies and consumer-focused product development and marketing issues, her knowledge of Amazon from having served as a director since 1997, as well as her customer experience skills and skills relating to public policy and financial statement and accounting matters.

Wendell P. Weeks, age 59, has been a director since February 2016. Mr. Weeks has been the Chief Executive Officer of Corning Incorporated, a glass and materials science innovator, since April 2005; Chairman of the board of directors since April 2007; and President since December 2010. He has held leadership roles in financial management, business development, commercial leadership, and general management across many of Corning’s businesses and technologies since joining the company in 1983. Mr. Weeks has served as a director of Merck & Co., Inc. since February 2004. Mr. Weeks’ individual qualifications and skills as a director include his leadership and operations experience as a senior executive at a large corporation with international operations, experience with product development, as well as his customer experience skills and skills relating to financial statement and accounting matters.

Corporate Governance

General

Board Leadership. The Board is responsible for the control and direction of the Company. The Board represents the shareholders and its primary purpose is to build long-term shareholder value. The Chair of the Board is selected by the Board and currently is the CEO, Jeff Bezos. The Board believes that this leadership structure is appropriate given Mr. Bezos’ role in founding Amazon and his significant ownership stake. The Board believes that this leadership structure improves the Board’s ability to focus on key policy and operational issues and helps the Company operate in the long-term interests of shareholders. In addition, the independent directors on the Board have appointed a lead director from the Board’s independent directors, currently Jonathan J. Rubinstein, in order to promote independent leadership of the Board. The lead director presides over the executive sessions of the independent directors, chairs Board meetings in the Chair’s absence, and provides direction on agendas, schedules, information, and materials for Board meetings that will be most helpful to the independent directors. In addition, the lead director confers from time to time with the Chair of the Board and the independent directors and reviews, as appropriate, the annual schedule of regular Board meetings and major Board meeting agenda topics. The guidance and direction provided by the lead director reinforce the Board’s independent oversight of management and contribute to communication among members of the Board.BOARD OF DIRECTORS INFORMATION

Jamie S. Gorelick Partner with Wilmer Cutler Pickering Hale and Dorr LLP | Background Ms. Gorelick has been a partner with the law firm Wilmer Cutler Pickering Hale and Dorr LLP since July 2003. She has held numerous positions in the U.S. government, serving as Deputy Attorney General of the United States, General Counsel of the Department of Defense, Assistant to the Secretary of Energy, and a member of the bipartisan National Commission on Terrorist Threats Upon the United States. Ms. Gorelick has served as a director of VeriSign, Inc. since January 2015, a director of United Technologies Corporation from February 2000 to December 2014, and a director of Schlumberger Limited from April 2002 to June 2010. Qualifications and Skills Ms. Gorelick’s individual qualifications and skills as a director include her experience as a lawyer, her leadership experience in senior governmental positions, including experience with regulatory and compliance matters, as well as her customer experience skills and skills relating to public policy and financial statement and accounting matters. |

Age: | Director since: | Board committees: | Other current public company boards: | |||

69 | February 2012 | Nominating and Corporate Governance (Chair) | VeriSign, Inc. |

6

Daniel P. Huttenlocher Dean of MIT Schwarzman College of Computing | Background Mr. Huttenlocher has been the Dean of MIT Schwarzman College of Computing since August 2019. He served as Dean and Vice Provost, Cornell Tech at Cornell University from 2012 to July 2019 and worked for Cornell University from 1988 to 2012 in various positions. Mr. Huttenlocher has served as a director of Corning Incorporated since February 2015. Qualifications and Skills Mr. Huttenlocher’s individual qualifications and skills as a director include his experience in senior positions at MIT and Cornell University, both leading universities, Cornell Tech, a research, technology commercialization, and graduate-level educational facility, and the Xerox Palo Alto Research Center, a technology research facility, through which he gained experience with emerging technologies, as well as his customer experience skills. |

Age: | Director since: | Board committees: | Other current public company boards: | |||

61 | September 2016 | Leadership Development and Compensation | Corning Incorporated |

2020 Proxy Statement | 7 | |||

Director Independence. The Board has determined that the following directors are independent as defined by Nasdaq rules: Mr. Alberg, Ms. Brewer, Ms. Gorelick, Mr. Huttenlocher, Ms. McGrath, Ms. Nooyi, Mr. Rubinstein, Mr. Ryder, Ms. Stonesifer, and Mr. Weeks. In addition, the Board determined that John Seely Brown, who served as a director through May 2018, was independent during the time he served as a director. In assessing directors’ independence, the Board took into account certain transactions, relationships, and arrangements involving some of the directors and concluded that such transactions, relationships, and arrangements did not impair the independence of the director. For Ms. Brewer and Mr. Weeks, the Board considered payments in the past three years in the ordinary course of business from the Company to Starbucks Corporation and Corning Incorporated, respectively, or their affiliates. All such payments were not significant for any of these companies. For Mr. Alberg, the Board considered that Amazon and its executive officers have in the past and may in the future invest in investment funds managed by entities where Mr. Alberg is a managing director or partner or in companies in which those funds invest, and that Amazon has in the past and may in the future engage in transactions with companies in which these funds have invested. For Mr. Ryder, the Board considered that hisson-in-law has been employed with Amazon since 2008 in anon-officer andnon-strategic position, as disclosed in “Certain Relationships and Related Person Transactions.”

Risk Oversight.As part of regular Board and committee meetings, the directors oversee executives’ management of risks relevant to the Company. While the full Board has overall responsibility for risk oversight, the Board has delegated responsibility related to certain risks to the Audit Committee and the Leadership Development and Compensation Committee. The Audit Committee is responsible for overseeing management of risks related to our financial statements and financial reporting process, data privacy and security, business continuity, and operational risks, the qualifications, independence, and performance of our independent auditors, the performance of our internal audit function, legal and regulatory matters, and our compliance policies and procedures. The Leadership Development and Compensation Committee is responsible for overseeing management of risks related to succession planning and compensation for our executive officers and our overall compensation program, including our equity-based compensation plans, as well as risks related to human resources matters, including workplace discrimination and harassment. The full Board regularly reviews reports from management on various aspects of our business, including related risks and tactics and strategies for addressing them. At least annually, the Board reviews our CEO succession planning as described in our Board of Directors Guidelines on Significant Corporate Governance Issues.

Corporate Governance Documents. Please visit our investor relations website atwww.amazon.com/ir, “Corporate Governance,” for additional information on our corporate governance, including:BOARD OF DIRECTORS INFORMATION

our Certificate of Incorporation and Bylaws;

Judith A. McGrath Senior Advisor to Astronauts Wanted * No experience necessary | Background Ms. McGrath serves as a senior advisor to Astronauts Wanted * No experience necessary, a multimedia joint venture that Ms. McGrath formed with Sony Music Entertainment, and served as President of Astronauts Wanted from June 2013 to March of 2018. The company is currently a subsidiary of Sony Pictures Television. Ms. McGrath served as Chair and Chief Executive Officer of MTV Networks Entertainment Group worldwide, a division of Viacom, Inc., including Comedy Central and Nickelodeon, from July 2004 until May 2011. She was part of the original founder and launch team for MTV. Qualifications and Skills Ms. McGrath’s individual qualifications and skills as a director include her leadership and multimedia operations experience as a longtime senior executive of MTV Networks Entertainment Group, through which she gained experience with content creation, advertising, and content distribution, as well as her customer experience skills. Ms. McGrath further honed her digital and entrepreneurial experience with global customers in her role at Astronauts Wanted * No experience necessary. |

Age: | Director since: | Board committees: | Other current public company boards: | |||

67 | July 2014 | Leadership Development and Compensation (Chair) | None |

the Board of Directors Guidelines on Significant Corporate Governance Issues, which includes policies on shareholder communications with the Board, director attendance at our annual meetings, director resignations to facilitate our majority vote standard, director stock ownership guidelines, succession planning, and compensation clawbacks;

Indra K. Nooyi Former Chairman and CEO of PepsiCo, Inc. | Background Mrs. Nooyi was the Chief Executive Officer of PepsiCo, Inc., a multinational food, snack, and beverage company, from October 2006 to October 2018, where she also served as the Chairman of its board of directors from May 2007 to February 2019. She was elected to PepsiCo’s board of directors and became its President and Chief Financial Officer in 2001, and held leadership roles in finance, corporate strategy and development, and strategic planning after joining PepsiCo in 1994. Mrs. Nooyi served as a director of Schlumberger Limited from April 2015 to April 2020. Qualifications and Skills Mrs. Nooyi’s individual qualifications and skills as a director include her leadership experience as a longtime senior executive at a large corporation with international operations, through which she gained experience with consumer-focused product development, international operations, and marketing issues, as well as her customer experience skills and skills relating to financial statement and accounting matters. |

Age: | Director since: | Board committees: | Other current public company boards: | |||

64 | February 2019 | Audit | None |

the charters approved by the Board for the Audit Committee, the Leadership Development and Compensation Committee, and the Nominating and Corporate Governance Committee;

the Code of Business Conduct and Ethics; and

our Political Expenditures Statement.

In addition, we provide information regarding our sustainability, environmental, and diversity activities on our website. We encourage you to read more about the many ways we are addressing these issues through our “About Amazon” website atwww.aboutamazon.com, our sustainability website atwww.amazon.com/sustainability, our Amazon Sustainability Question Bank at www.amazon.com/qb,our diversity website atwww.amazon.com/diversity, and our Amazon “Day One” blog at blog.aboutamazon.com.

7

8 |

| |||||

Board Meetings and CommitteesBOARD OF DIRECTORS INFORMATION

The Board meets regularly during the year, and holds special meetings and acts by unanimous written consent whenever circumstances require. During 2018, there were six meetings of the Board. All incumbent directors attended at least 75% of the aggregate of the meetings of the Board and committees on which they served occurring during 2018. All directors then serving attended the 2018 Annual Meeting of Shareholders.

The Board has established an Audit Committee, a Leadership Development and Compensation Committee, and a Nominating and Corporate Governance Committee, each of which is comprised entirely of directors who meet the applicable independence requirements of the Nasdaq rules. The Committees keep the Board informed of their actions and provide assistance to the Board in fulfilling its oversight responsibility to shareholders. The table below provides current membership information as well as meeting information for the last fiscal year.

Name | Audit Committee | Leadership Development and Compensation Committee | Nominating and Corporate Governance Committee | ||||||||||||

Jeffrey P. Bezos | |||||||||||||||

Tom A. Alberg(1) | X | ||||||||||||||

Rosalind G. Brewer(2) | X | ||||||||||||||

Jamie S. Gorelick | X | * | |||||||||||||

Daniel P. Huttenlocher | X | ||||||||||||||

Judith A. McGrath | X | * | |||||||||||||

Indra K. Nooyi(3) | X | ||||||||||||||

Jonathan J. Rubinstein | X | ||||||||||||||

Thomas O. Ryder | X | * | |||||||||||||

Patricia Q. Stonesifer | X | ||||||||||||||

Wendell P. Weeks | X | ||||||||||||||

Total Meetings in 2018 | 6 | 3 | 5 | ||||||||||||

Jonathan J. Rubinstein Formerco-CEO of Bridgewater Associates, LP |

Background Mr. Rubinstein wasco-CEO of Bridgewater Associates, LP, a global investment management firm, from May 2016 to April 2017. Previously, Mr. Rubinstein was Senior Vice President, Product Innovation, for the Personal Systems Group at the Hewlett-Packard Company (“HP”), a multinational information technology company, from July 2011 to January 2012, and served as Senior Vice President and General Manager, Palm Global Business Unit, at HP from July 2010 to July 2011. Mr. Rubinstein was Chief Executive Officer and President of Palm, Inc., a smartphone manufacturer, from June 2009 until its acquisition by HP in July 2010, and Chairman of the Board of Palm, Inc. from October 2007 through the acquisition. Prior to joining Palm, Mr. Rubinstein was a Senior Vice President at Apple Inc., also serving as the General Manager of the iPod Division. Mr. Rubinstein served as a director of Qualcomm Incorporated from May 2013 to May 2016. Qualifications and Skills Mr. Rubinstein’s individual qualifications and skills as a director include his leadership and technology experience as a senior executive at large financial and technology companies, through which he gained experience with hardware devices and emerging technologies, as well as his customer experience skills and skills relating to financial statement and accounting matters. |

Age: | Director since: | Board committees: | Other current public company boards: | |||

63 | December 2010 | Nominating and | None |

Thomas O. Ryder Former Chairman and CEO of Reader’s Digest Association, Inc. | Background Mr. Mr. Ryder served as a director of ILG, Inc. from May 2016 to September 2018, a director of RPX Corporation from December 2009 to June 2017, a director of Quad/Graphics, Inc. from July 2010 to May 2017, a director of Starwood Hotels & Resorts Worldwide, Inc. from April 2001 to September 2016, and Chairman of the Qualifications and Skills Mr. Ryder’s individual qualifications and skills as a director include his leadership experience as a senior executive of Reader’s Digest, a large media and publishing company, and American Express, a large financial services company, through which he gained experience with intellectual property, media, enterprise sales, payments, and international operations, as well as his customer experience skills and skills relating to financial statement and accounting matters. |

Age: |

| Board committees: | Other current public company boards: |

75 |

| November 2002 | Audit | None |

The functions performed by these Committees, which are set forth in more detail in their charters, are summarized below.

Audit Committee. The Audit Committee represents and assists the Board in fulfilling its oversight responsibility relating to our financial statements and financial reporting process, the qualifications, independence, and performance of our independent auditors, the performance of our internal audit function, legal and regulatory matters, and our compliance policies and procedures. The Board has designated each of Messrs. Alberg, Ryder, and Weeks, and Ms. Nooyi as an Audit Committee Financial Expert, as defined by Securities and Exchange Commission (“SEC”) rules. During the past year, the Audit Committee met with management and reviewed matters that included the Company’s risk assessment and compliance functions, information security, public policy expenditures, treasury and investment matters, accounting industry issues, the reappointment of our independent auditor, and pending litigation. The Audit Committee also met with the auditors to review the scope and results of the auditor’s annual audit and quarterly reviews of the Company’s financial statements.

8

2020 Proxy Statement | 9 | |||

Leadership DevelopmentBOARD OF DIRECTORS INFORMATION

Patricia Q. Stonesifer Former President and CEO of Martha’s Table | Background Ms. Stonesifer served as the President and CEO of Martha’s Table, anon-profit, from April 2013 to March 2019. She served as Chair of the Board of Regents of the Smithsonian Institution from January 2009 to January 2012 and as Vice Chair from January 2012 to January 2013. From September 2008 to January 2012, she served as senior advisor to the Bill and Melinda Gates Foundation, a private philanthropic organization, where she was Chief Executive Officer from January 2006 to September 2008 and President andCo-chair from June 1997 to January 2006. Since September 2009, she has also served as a private philanthropy advisor. From 1988 to 1997, she worked in many roles at Microsoft Corporation, including as a Senior Vice President of the Interactive Media Division, and also served as the Chairwoman of the Gates Learning Foundation from 1997 to 1999. Qualifications and Skills Ms. Stonesifer’s individual qualifications and skills as a director include her leadership experience as a senior executive at the Bill and Melinda Gates Foundation and at Microsoft, through which she gained experience with emerging technologies and consumer-focused product development and marketing issues, her knowledge of Amazon from having served as a director since 1997, as well as her customer experience skills and skills relating to public policy and financial statement and accounting matters. |

Age: | Director since: | Board committees: | Other current public company boards: | |||

63 | February 1997 | Nominating and Corporate | None |

Wendell P. Weeks Chairman, President, and CEO of Corning Incorporated | Background Mr. Weeks has been the Chief Executive Officer of Corning Incorporated, a glass and materials science innovator, since April 2005; Chairman of the board of directors since April 2007; and President since December 2010. He has held leadership roles in financial management, business development, commercial leadership, and general management across many of Corning’s businesses and technologies since joining the company in 1983. Mr. Weeks has served as a director of Merck & Co., Inc. since February 2004 and will not be standing for re-election to Merck & Co.’s Board of Directors at its 2020 annual meeting of shareholders. Qualifications and Skills Mr. Weeks’ individual qualifications and skills as a director include his leadership and operations experience as a senior executive at a large corporation with international operations, experience with product development, as well as his customer experience skills and skills relating to financial statement and accounting matters. |

Age: | Director since: | Board committees: | Other current public company boards: | |||

60 | February 2016 | Audit | Corning Incorporated, Merck & Co., Inc. |

10 |

| |||||

BOARD OF DIRECTORS INFORMATION

Director Nominee Tenure, Skills, and Compensation Committee. The Leadership Development and Compensation Committee evaluates our programs and practices relating to leadership development, reviews and establishes compensation of the Company’s executive officers, and oversees management of risks for succession planning and our overall compensation program, including our equity-based compensation plans, all with a view toward maximizing long-term shareholder value. The Committee may engage compensation consultants but did not do so in 2018. Additional information on the Committee’s processes and procedures for considering and determining executive compensation is contained in the “Compensation Discussion and Analysis” section of this Proxy Statement. During the past year, the Leadership Development and Compensation Committee met with management and reviewed matters that included the design, amounts, and effectiveness of the Company’s compensation of senior executives, management succession planning, the Company’s benefit and compensation programs, the Company’s human resources programs, including review of workplace discrimination and harassment reports, and feedback from the Company’s shareholder engagement.Characteristics

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee reviews and assesses the composition of the Board, assists in identifying potential new candidates for director, recommends candidates for election as director, and provides a leadership role with respect to our corporate governance. The Nominating and Corporate Governance Committee also recommends to the Board compensation for newly elected directors and reviews director compensation as necessary. During the past year, the Nominating and Corporate Governance Committee met with management and reviewed matters that included the Board’s composition, diversity, and skills in the context of identifying and evaluating new director candidates to join the Board, the Board’s recruitment and self-evaluation processes, Board Committee membership and qualifications, consideration of feedback from the Company’s shareholder engagement, Board compensation, and corporate governance developments.

Director Nominations. The Nominating and Corporate Governance Committee considers candidates for director who are recommended by its members, by other Board members, by shareholders, and by management, as well as those identified by a third-party search firm retained to assist in identifying and evaluating possible candidates. Ms. Brewer and Ms. Nooyi were each initially recommended to the Nominating and Corporate Governance Committee by a third-party search firm pursuant to a director recruitment process conducted in 2017 and 2018. The Nominating and Corporate Governance Committee annually reviews the tenure, performance, and contributions of existing Board members to the extent they are candidates forre-election, and considers all aspects of each candidate’s qualifications and skills in the context of the Company’s needs at that point in time and, as stated in the Board of Directors Guidelines on Significant Corporate Governance Issues, seeks out candidates with a diversity of experience and perspectives, including diversity with respect to race, gender, geography, and areas of expertise. The Nominating and Corporate Governance Committee includes, and has any search firm that it engages include, women and minority candidates in the pool from which the Committee selects director candidates. When considering candidates as potential Board members, the Board and the Nominating and Corporate Governance Committee evaluate the candidates’ ability to contribute to such diversity. The Board assesses its effectiveness in this regard as part of its annual Board and director evaluation process. Currently, over half of our independent director nominees are women and overalmost half of our independent director nominees have served for fewer than five years. Our Board’s composition also represents a balanced approach to director tenure, allowing the Board to benefit from the experience of longer-serving directors combined with fresh perspectives from newer directors (with threetwo new directorson-boarding and threetwo directors leaving in the last three years). The tenure range of our director nominees is as follows:

Tenure on Board | Number of Director Nominees | |

More than 10 years | 3 | |

6-10 years | ||

1-5 years | ||

9

Among the qualifications and skills of a candidate considered important by the Nominating and Corporate Governance Committee are: a commitment to representing the long-term interests of shareholders; customer experience skills; Internet savvy; an inquisitive and objective perspective; the willingness to take appropriate risks; leadership ability; human capital management; personal and professional ethics, integrity, and values; practical wisdom and sound judgment; international business experience; and business and professional experience in fields such as retail, operations, technology, finance/accounting, product development, intellectual property, law, multimedia entertainment, and marketing. When evaluating

re-nominationCorporate Governance

Board Leadership

The Board is responsible for the control and direction of existingthe Company. The Board represents the shareholders and its primary purpose is to build long-term shareholder value. The Chair of the Board is selected by the Board and currently is the CEO, Jeff Bezos. The Board believes that this leadership structure is appropriate given Mr. Bezos’ role in founding Amazon and his significant ownership stake. The Board believes that this leadership structure improves the Board’s ability to focus on key policy and operational issues and helps the Company operate in the long-term interests of shareholders. In addition, the independent directors the Committee also considers the nominees’ past and ongoing effectiveness on the Board have appointed a lead director from the Board’s independent directors, currently Jonathan J. Rubinstein, in order to promote independent leadership of the Board. The lead director presides over the executive sessions of the independent directors, chairs Board meetings in the Chair’s absence, works with management and the independent directors to approve agendas, schedules, information, and materials for Board meetings, and is available to engage directly with major shareholders where appropriate. In addition, the lead director confers from time to time with the exceptionChair of the Board and the independent directors and reviews, as appropriate, the annual schedule of regular Board meetings and major Board meeting agenda topics. The guidance and direction provided by the lead director reinforce the Board’s independent oversight of management and contribute to communication among members of the Board.

2020 Proxy Statement | 11 | |||

BOARD OF DIRECTORS INFORMATION

Director Independence

The Board has determined that the following directors are independent as defined by Nasdaq rules: Ms. Brewer, Ms. Gorelick, Mr. Bezos,Huttenlocher, Ms. McGrath, Mrs. Nooyi, Mr. Rubinstein, Mr. Ryder, Ms. Stonesifer, and Mr. Weeks. In addition, the Board determined that Tom A. Alberg, who served as a director through May 2019, was independent during the time he served as a director. In assessing directors’ independence, the Board took into account certain transactions, relationships, and arrangements involving some of the directors and concluded that such transactions, relationships, and arrangements did not impair the independence of the director. For Ms. Brewer and Mr. Weeks, the Board considered payments in the past three years in the ordinary course of business from the Company to Starbucks Corporation and Corning Incorporated, respectively, or their affiliates. All such payments were not significant for any of these companies. For Mr. Alberg, the Board considered that Amazon and its executive officers have in the past invested in investment funds managed by entities where Mr. Alberg is an employee, their independence.a managing director or partner or in companies in which those funds invest, and that Amazon has in the past engaged in transactions with companies in which these funds have invested. For Mr. Ryder, the Board considered that hisson-in-law has been employed with Amazon since 2008 in anon-officer andnon-strategic position, as disclosed in “Certain Relationships and Related Person Transactions.”

Risk Oversight

As part of regular Board and committee meetings, the directors oversee executives’ management of risks relevant to the Company. While the full Board has overall responsibility for risk oversight, the Board has delegated responsibility related to certain risks to the Audit Committee, the Leadership Development and Compensation Committee, and the Nominating and Corporate Governance Committee. The Audit Committee is responsible for overseeing management of risks related to our financial statements and financial reporting process, data privacy and security, business continuity, and operational risks, the qualifications, independence, and performance of our independent auditors, the performance of our internal audit function, legal and regulatory matters, and our compliance policies and procedures. The Leadership Development and Compensation Committee is responsible for overseeing management of risks related to succession planning and compensation for our executive officers and our overall compensation program, including our equity-based compensation plans, as well as risks related to other human capital management matters, including workplace safety, culture, diversity, discrimination, and harassment. The Nominating and Corporate Governance Committee believesis responsible for overseeing management of risks related to our environmental, sustainability, and corporate social responsibility practices, including risks related to our operations and our supply chain. The full Board regularly reviews reports from management on various aspects of our business, including related risks and tactics and strategies for addressing them. At least annually, the Board reviews our CEO succession planning as described in our Board of Directors Guidelines on Significant Corporate Governance Issues.

Corporate Governance Documents

Please visit our investor relations website atwww.amazon.com/ir, “Corporate Governance,” for additional information on our corporate governance, including:

our Restated Certificate of Incorporation and Bylaws;

the Board of Directors Guidelines on Significant Corporate Governance Issues, which includes policies on shareholder communications with the Board, director attendance at our annual meetings, director resignations to facilitate our majority vote standard, director stock ownership guidelines, succession planning, and compensation clawbacks;

the charters approved by the Board for the Audit Committee, the Leadership Development and Compensation Committee, and the Nominating and Corporate Governance Committee;

the Code of Business Conduct and Ethics; and

our Political Expenditures Statement.

12 |

| |||||

BOARD OF DIRECTORS INFORMATION

Sustainability